National

Revision in policy makes it easier for returnee migrant workers to access soft loan

The government has removed the limit of three years after returning from foreign employment and the need to produce a skill certificate.

Chandan Kumar Mandal

Some major changes in policy, introduced to provide interest-subsidised loans for promoting enterprises inside the country, will allow returnee migrant workers to access financial support.

The latest changes in the 'Integrated Guidelines on Interest Exemption of Subsidised Loan, 2075' remove some provisions that had been adding hassles for migrant workers to claim the loans offered by the government.

For accessing the soft loan, migrant workers were required to have not crossed three years of returning from a foreign job and to produce a skill certificate to prove their experience in the sector they would be starting their new business.

According to Uttam Adhikari, chairperson of the Returnee Migrants’ Network, an organisation established by migrant workers who once worked in various labour destination countries, such requirements had been restricting candidates right from the start of the application process.

Now the government has revised these clauses and removed the cap of three years after returning from foreign employment and the need to produce a skill certificate.

“Such provisions had been adding complications to returnee migrant workers who wanted to start their own enterprise in the country. A majority of them could not even apply, let alone get the loan,” Adhikari told the Post. “With the revisions in the working procedure, there will be some ease for migrant workers.”

Last year, the government rolled out a soft loan scheme to utilise the skills, experience and occupational training of migrant workers within the country. The scheme, under which workers get soft loans of up to Rs1 million, was also aimed at retaining migrant workers inside the country and putting an end to the cycle of migration.

The new changes in policy make all the returnee migrants eligible to apply for the fund irrespective of the duration of their return. Also, they can start any business, unlike the earlier provision which required them to start a business in the sector they were experienced during foreign employment. Each member of a joint business venture can get up to Rs1 million now. Earlier, a group business plan got only Rs1 million.

“Producing skill certificates is a difficult task for migrant workers. Since construction workers, workers employed by supply companies where the job changes every few months and domestic workers cannot prove their skills, they remain away from such support,” said Adhikari.

A beneficiary had to submit a clear business plan along with necessary documents to qualify for the fund, available at low-interest rates. After the scheme was rolled out, thousands of returnee workers had lined up to submit their business plan and receive the state funding.

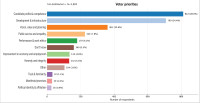

Nearly 18,000 applicants had applied for a soft loan. Most of the startup plans were about starting hotels, restaurants, beauty parlours, agriculture-based business and buying vehicles for public transportation services, according to Adhikari.

The Foreign Employment Board, the government body which sought applications from returnee migrant workers, had forwarded the business proposal to concerned ministries and commercial banks for providing loans. However, only a handful of them had access to the fund.

“Progress was not satisfactory because of poor coordination between the board and banks,” said Adhikari. “The foreign employment board had recommended loans, but banks did not approve the plan.”

12.62°C Kathmandu

12.62°C Kathmandu