Money

Stock market jumps 34.98 points

Stockbrokers attribute the rise to increasing transactions in line with growing absorption capacity and other policy factors

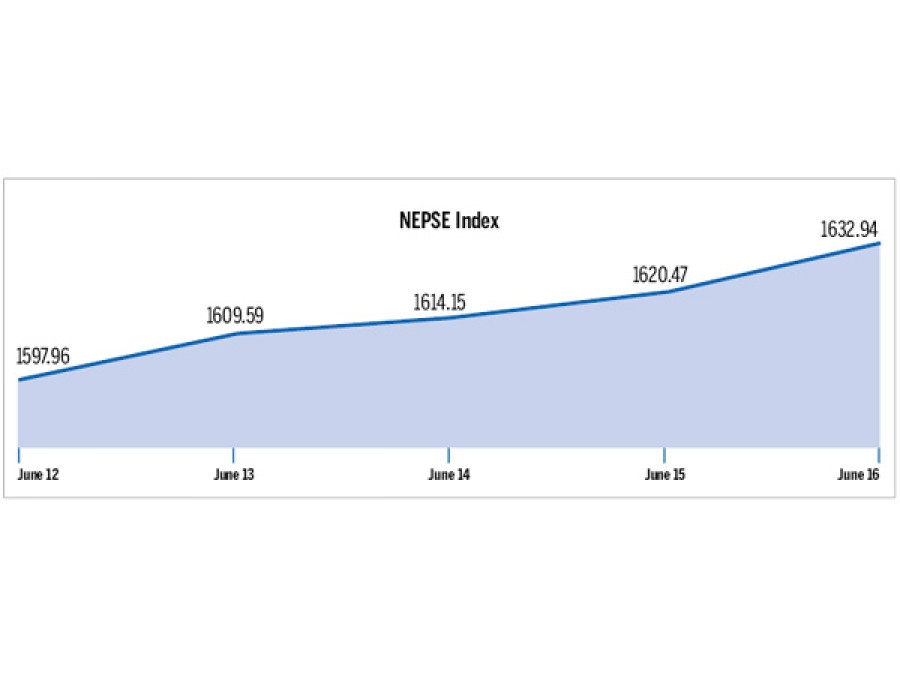

Nepal Stock Exchange (Nepse) last week jumped 34.98 points to close at 1632.94 points.

The market that opened at 1597.96 points on Sunday posted gains throughout the week. The biggest gain came on Thursday when the market rose 12.47 points. Stockbrokers attributed the rise to increasing transactions in line with growing absorption capacity and other policy factors.

“Factors like growing business opportunity in the insurance sector along with discussions over the regulation of the microfinance sector contributed to the growth,” said Suchita Khanal, chairperson of Sweta securities. “In the banking sector, the market demand was immediately pulled down with an oversupply of shares. Thus, the sub-index posted slight loss this week.”

According to Khanal, the debate over Banks and Financial Institutions Act (Bafia) has dented investor confidence.

Of the nine trading groups, six posted gains. The insurance sector (up 660.86 points) led the gainers’ side including hydropower, manufacturing, development banks, hotels and finance. The losers were commercial banks and others. The trading group was stable at 201.38 points. The sensitive index that measures the performance of “A” class companies rose by 6.68 to close at 352.63 points. The transaction volume jumped 35.86 percent during the week to Rs9.30 billion. The total number of shares traded also increased from 15.93 million from 9.2 million. The exchange has been witnessing daily transaction of more than Rs1 billion in recent days.

Nepal Bangladesh Bank led the charts in terms of turnover (Rs788.2 million) and number of transactions (2,680). The bank’s announcement of plans to issue 80 percent right’s shares resulted in a massive trading of its shares. Siddhartha Equity Oriented Scheme posted the highest number of scrip traded (3.5 million).

Six companies—Kumari Bank, Nerude Lagubitta Bikas Bank, NMB Microfinance, Jyoti Bikas Bank, Mount Makalu Development Bank, Ekta Bikas Bank—listed their bonus shares during the review period.

Nepal Insurance Co-Pro 490

United Insurance Co 436.86

Everest Bank 386.12

Rural Microfinance Dev Center 278.45

Insurance 660.86

Hydropower 103.77

Manufacturing 52.68

Development Banks 89.68

Hotels 25.32

Finance 4.17

Others -3.52

Commercial Banks: -0.43

25.92°C Kathmandu

25.92°C Kathmandu