Columns

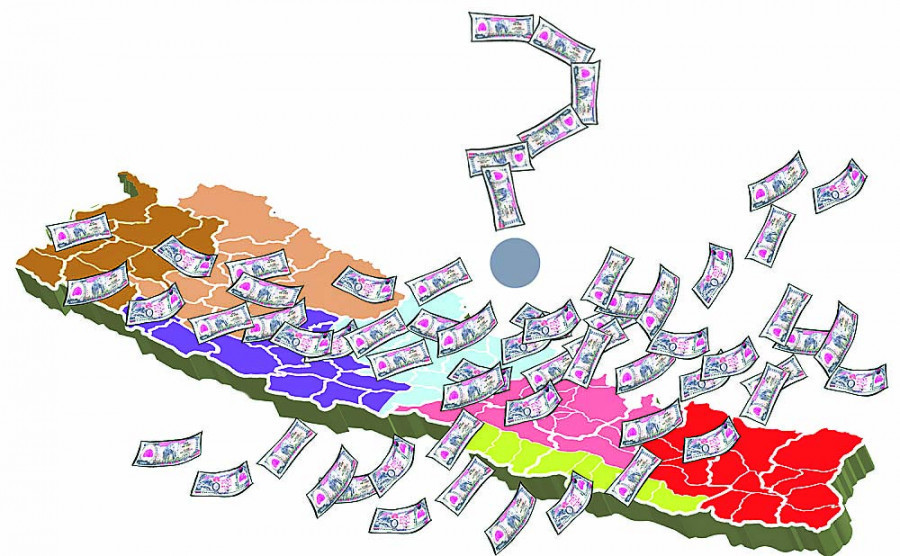

Fine-tuning fiscal federalism

The share of fiscal equalisation grants should be increased in proportion to the GDP.

Khim Lal Devkota

While discussing the various aspects of federalism, it is necessary to analyse its political, administrative and fiscal aspects. Fiscal federalism includes four dimensions: functional responsibility, revenue rights, intergovernmental fiscal transfers and internal borrowings. In the context of Nepal, revenue sharing from value added tax and excise duty, and royalty distribution from natural resources are also taken as part of fiscal federalism.

After newly sworn-in Deputy Prime Minister and Infrastructure Minister Narayan Kaji Shrestha issued instructions to repair the roads in Kathmandu Valley within 15 days, various media outlets reported that the directions were not followed. This is an example of overstepping one’s jurisdiction. As per the constitution, local roads fall under the jurisdiction of the local government, but the centre has not yet transferred the authority to local governments. Not only roads, but all responsibilities related to local infrastructure development fall under the jurisdiction of the local government.

Problems with ownership and accountability arise when work in one’s jurisdiction is done by another. The federal government has encroached on the jurisdiction of the sub-national level.

Highly centralised

In Nepal’s federal system, the revenue part is highly centralised. This problem may have occurred due to the customs-based revenue system. But something more could be done regarding the revenue rights of the provinces. The sub-national levels have made no effort to increase internal revenue. The proportion of internal revenue in the provincial budget is about 20 percent. As per the 59th report of the Office of the Auditor General, the share of internal sources in local revenue is less than 10 percent.

The constitution mentions that the allocation of fiscal equalisation grants to the sub-national level should be done based on their revenue capacity and expenditure needs.

So it is necessary to update the details regularly at the sub-national level. What is more important is that the revenue potentiality should be utilised. The sub-national levels should draft a revenue improvement action plan. The exploitation of natural resources such as river materials is increasing haphazardly, and crusher factories are at the forefront of such exploitation. There has always been a dispute between the provincial and local levels regarding the collection and distribution of these resources. This issue has not been resolved yet.

The sub-national-level loan management system has yet to be developed. The legal structure was recently created, but the institutional structure has not taken shape. There is still a lot of work to be done in this field.

The constitution stipulates that the volume of fiscal transfers received by the sub-national level shall be in accordance with the recommendations of the National Natural Resources and Fiscal Commission. But the commission does not have much of a role in other grants except fiscal equalisation grants. Laws designed to weaken the commission must be amended. But more importantly, the commission must move forward in accordance with its rights.

As per the basic principles of grant distribution, the share of fiscal equalisation grants should be increased in proportion to the gross domestic product (GDP) or budget side. But the ratio of fiscal equalisation grants being distributed to the sub-national levels has been declining while the ratio of conditional grants has been increasing unexpectedly. Meanwhile, in the name of conditional grants, small programmes and projects have been sent to the sub-national levels, creating an unnecessary burden for them.

According to the Ministry of Federal Affairs and General Administration, five local governments have not yet approved their policies, programmes and budgets. The budget must be passed by the second week of July, or it cannot be spent. The basic theory of economics is that the higher the expenditure, the greater the development. So failure to publish the budget on time also means closing the doors to development.

Performance-based grant

It is necessary to implement a performance-based grant distribution system at the local level as before. There are problems with governance reform and fiscal discipline in Madhesh, Karnali and Sudurpaschim provinces. If this system is implemented, many problems seen at the local level will be solved. This system can be applied at these three provinces as a start.

Nepal's national budget is issued on May 30, but the provinces do not get information about the plans and programmes of the federal government until the second week of June. In order to solve this problem, the annual programmes and projects should be made public at the time of submitting the budget.

The authority of Singha Durbar has been devolved to the local level, but there is a complaint that another Singha Durbar has been created at the local level. Further, there are complaints that there is no equitable distribution of local-level resources at the ward level. Many previous village development committees have now been converted to wards. It has been observed that people have not received the expected services from the ward office. It is necessary for the local levels to be serious about making the wards effective and distributing resources at the local level equitably.

14.12°C Kathmandu

14.12°C Kathmandu