Opinion

More effort required

Demands for larger role of the government in capital formation are legitimate

Prience Shrestha

The preliminary Economic Survey Report for fiscal year 2015-16 yet again makes the same old assertion regarding Nepal’s economic performance by exhibiting the underperforming state of capital expenditure that has been hampering the country’s real economic growth for a number of years. It is of no surprise that the yearly Gross Fixed Capital Formation (GFCF) is again below the required criteria warranted by Nepal’s economy that is characterised by a considerable capital/infrastructure deficit and strong potentiality of Marginal Productivity of added Capital (MPK). It is reasonably legitimate to recognise the strong potentiality of MPK in Nepal on technical grounds as it is categorised as a low-income country with a Gross Capital Formation that is way below the steady or optimum level of capital.

Key barrier

Statistically speaking, the GFCF for fiscal 2015-16, on the basis of the economic survey conducted by the Finance Ministry, was Rs562,458 million, which is only about 25 percent of the GDP. However, in the midst of this statistical figure, economist Chandan Sapkota draws the minimum threshold for the GCFC (as a percentage of the GDP) of about 30 percent in order to boost the required real economic growth of the country and lift the per-capita income and generate further employment based on Investment Expenditure. In this regard, the negative disparity between the required gross capital formation and the acquired gross capital formation in terms of a percentage of the GDP is numerically observed, whereas the observation of this deficit is highly relevant as every layman can see a lack of adequate infrastructure as being a major barrier to national progress.

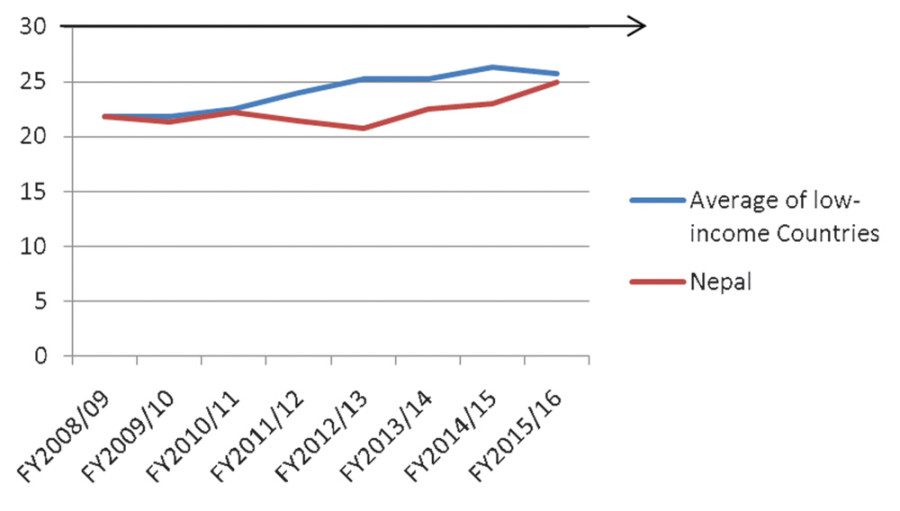

In order to bolster the argument regarding the state of capital formation deficiency in Nepal’s economy, we can refer to a comparison of the GCFC (as a percentage of the GDP) of Nepal with the average of low-income countries in the last eight years based on the World Bank’s data and the Economic Survey 2016. Since the countries belonging to the low-income category (including Nepal) share a common resolution, that is more investment expenditure, to fuel growth, the comparison is relevant to understand the relative performance of Gross Capital Formation in Nepal.

Nepal’s GFCF as a percentage of the GDP fell below the average of its kind in the last couple of years even though it appears to be on a reconvergence trend. Even then, the GCFC as a percentage of the GDP is considerably below the minimum threshold of 30 percent recommended for the nation’s real economic growth. When digging deeper into the component of the GFCF in Nepal’s economy, it is surprising to discover wide inequality in the volume contribution of Private Fixed Capital investment and Government/Public Fixed Capital investment. This figure stays put even though the planned expenditure commitment of the government is ballooning (more than Rs1,000 billion in the budget for fiscal 2016-17) in the midst of a huge role required of the government to fund infrastructure development. The ratio of private contribution to the GFCF to the government contribution was about 3.23 times in fiscal 2015-16 as per the Economic Survey 2016.

Low absorption rate

While observing the stark difference in the contributions of the two parties to the GFCF, it would be reasonable to conclude the underperforming role of the government in inhibiting the growth of the GFCF/GDP ratio while the leading role of the private sector even in the midst of a not-so-friendly regulatory environment exhibits strong enthusiasm. The persistent low absorption rate of the government budget hovering at about 75 percent due to a lagging delivery capacity of the performing stakeholders appears to be relatable to an observed underperformance from the government side.

On the flip side, the minuscule role of the government in economic affairs might seem to be reasonable to allow the free market system to take hold. But given the huge output gap in the merit and social sectors—like public infrastructure, health and education—in our underdeveloped economy that cannot be fulfilled by the private sector due to the lack of excludability and rivalry features of the sectors, the government is seen to be primarily and emergently responsible to close this output gap. Therefore, demands for a larger role of the government or the public sector in capital formation are legitimate. The pattern of statistical data definitely indicates that the government or the public sector is responsible for the observed underperformance of Capital Expenditure/Gross Fixed Capital Formation.

Shrestha has a master’s in Project Management from Curtin University, Australia

19.12°C Kathmandu

19.12°C Kathmandu