Money

BoP surplus for 1st time this fiscal yr

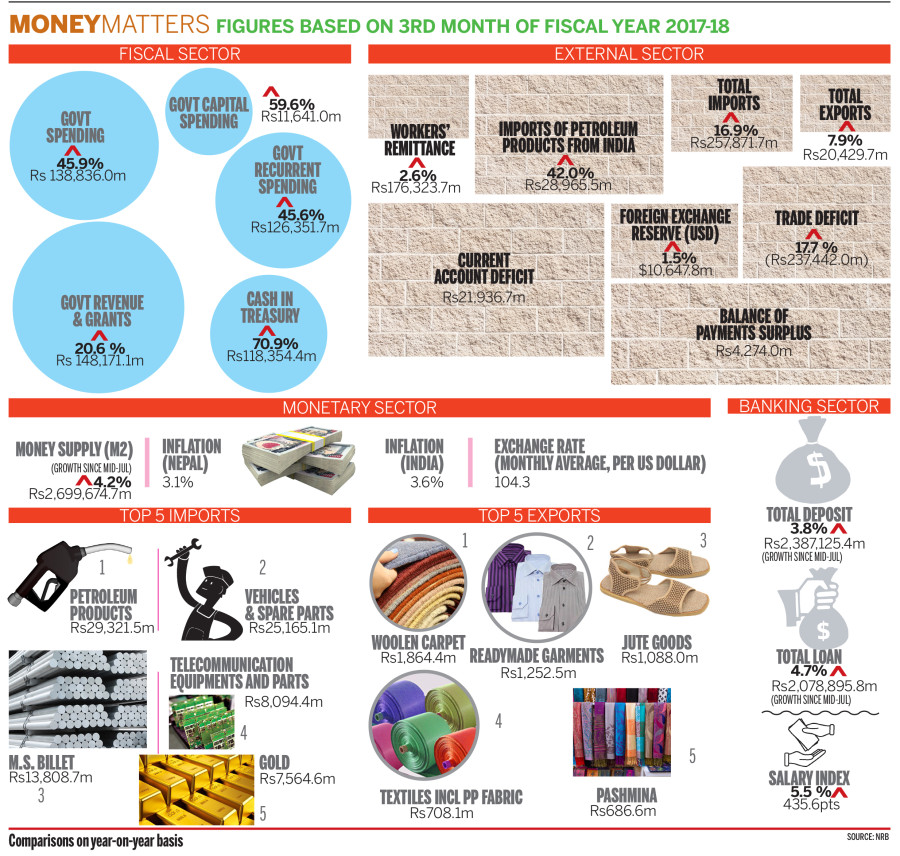

Nepal’s balance of payments finally reverted to a surplus in the third month of the current fiscal year, although the current account deficit widened sharply from the previous year due to deceleration in remittance inflow and rising imports, the latest report of the Nepal Rastra Bank (NRB) says.

Nepal’s balance of payments finally reverted to a surplus in the third month of the current fiscal year, although the current account deficit widened sharply from the previous year due to deceleration in remittance inflow and rising imports, the latest report of the Nepal Rastra Bank (NRB) says.

The balance of payments returned to a surplus of Rs4.3 billion in the first quarter of 2017-18, meaning inflow of funds into the economy surpassed outflows by Rs4.3billion. This is the first balance of payments surplus recorded by the country in the current fiscal year.

“Healthy capital and financial flows especially of capital account transfer, foreign direct investment and foreign loans have contributed to the return of overall balance of payments to a surplus,” says the central bank’s Macroeconomic Report made public on Sunday.

Nepal received capital transfer of Rs5 billion and foreign direct investment (FDI) of Rs6.1 billion in the first quarter of the current fiscal year. In the same period of the last fiscal year, capital transfer and FDI inflow stood at Rs2.4 billion and Rs5 billion, respectively.

These inflows helped the country’s foreign exchange reserves to grow by 1.5 percent to $10.7 billion in the first quarter. The current foreign exchange holdings is sufficient to cover merchandise imports of 13 months, and merchandise and services imports of 11.2 months, according to the NRB.

Despite a balance of payments surplus, current account posted a deficit of Rs21.9 billion in the three-month period compared to the deficit of Rs2 billion recorded in the same period of the last fiscal year. This was largely because of deceleration in remittance inflow and hike in imports.

Merchandise imports jumped 16.9 percent to Rs257.9 billion in the first quarter of this fiscal year due to hike in demand for petroleum products, gold, aircraft spare parts, vehicles and spare parts, and clinker, shows the NRB report. On the other hand, merchandise exports went up by mere 7.9 percent to Rs20.4 billion due to fall in overseas demand for juice, cardamom, GI pipes, woollen carpet and polyester yarn. Also, services trade deficit widened to Rs6.2 billion in the three-month period. Such deficit stood at Rs2.4 billion in the same period of last fiscal year. Services trade deficit widened as expenses made by Nepalis travelling abroad exceeded the country’s tourism income. Nepal’s tourism income stood at Rs14.9 billion in the first quarter of 2017-18, whereas expenses made by Nepalis travelling abroad hovered around Rs21 billion in the same period, NRB report shows. Also, around Rs13.2 billion left the country in the first quarter to cover transportation expenses, which include income repatriated by foreign airline companies operating flights to Nepal. This expenditure was 31 percent higher than in the same period of the last fiscal year.

While the country’s overseas expenses soared, the flow of money sent home by Nepalis working abroad rose by mere 2.6 percent to Rs176.3 billion in the first quarter of the current fiscal year. Remittance inflow had gone up by 3.2 percent in the same period of the last fiscal year.

Remittance inflow growth rate has been falling for quite some time due to fall in number of Nepalis leaving the country for employment purpose. The number of outbound workers fell by 2.6 percent in the first quarter of this fiscal year largely due to drop in number of workers leaving for key foreign job markets such as Saudi Arabia and Qatar.

NRB paints rosy pic of economy

KATHMANDU: The Nepal Rastra Bank (NRB) has painted a rosy picture of the economy in its third-quarter macroeconomic report. The central bank says that macroeconomic data available so far suggest “an optimistic growth outlook going forward”. Four factors underpin an improved growth outlook for 2017-18, according to the NRB. First, incessant rainfall of mid-August is expected to boost farm output this year. Second, the uninterrupted supply of energy and the near completion of some hydropower projects, including Chamelia, are likely to help augment the industrial capacity utilisation in the days ahead. Third, a rebound in tourism arrival, as reflected through an increase in hotel booking and occupancy rate, is expected to accelerate activities in associated services sectors. Fourth, a rise in import of clinker and iron related items is a reflection of acceleration in construction activities, says the central bank, adding, “Inflation has remained subdued at 3.1 percent in mid-October with sporadic rise and fall in prices of perishable items such as vegetables and fruits.” (PR)

22.37°C Kathmandu

22.37°C Kathmandu