Money

Govt’s revenue collection jumps over 40 percent

The government’s revenue collection jumped 43.8 percent in the first nine months of the current fiscal year on the back of a surge in tax and non-tax receipts.

The government’s revenue collection jumped 43.8 percent in the first nine months of the current fiscal year on the back of a surge in tax and non-tax receipts.

The government generated Rs419 billion in tax and non-tax receipts in the nine-month period of 2016-17, compared to Rs291.4 billion in the same period a year ago, according to the latest report by Nepal Rastra Bank.

The income generated during the period starting from mid-July to mid-April was 74 percent of its annual revenue collection target of Rs565.9 billion.

The government’s revenue surged in the first nine months of the current fiscal year due to higher collection of customs and excise duties, value added tax and registration fees, officials of the Ministry of Finance said.

In the last fiscal year, income from those headings had dropped sharply because of a trade blockade imposed by India which disrupted supplies of almost everything from essential goods to raw materials and petroleum products.

In a country where the government generates most of its income from taxes levied on imported goods, the supply disruption, which started in the fourth week of September 2015 and lasted till first week of February 2016, dealt a huge blow to Nepal.

But since the normalisation in the supply situation following the end of the trade embargo, consumption has picked up, raising imports and thereby government’s revenue.

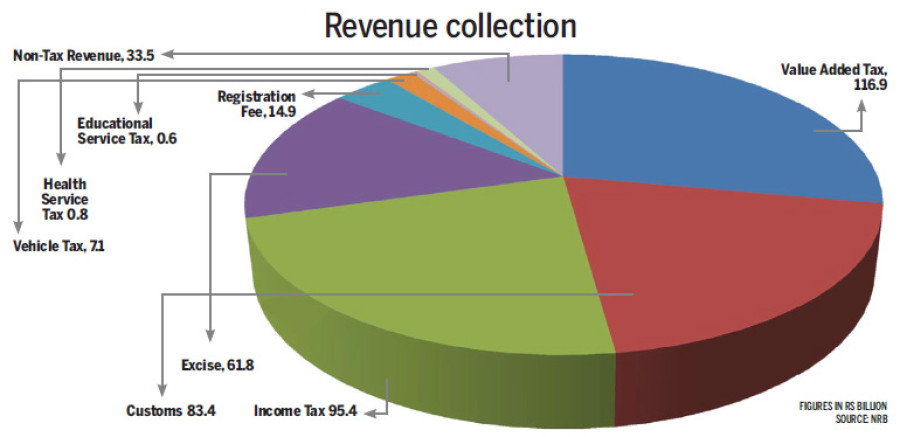

In the first nine months of 2016-17, value added tax (VAT) made the biggest contribution to the government’s revenue. The government raised Rs116.9 billion in VAT in the nine-month period-up 56.4 percent-making a contribution of 27.9 percent to the total revenue. In the same period last fiscal year, the government collected Rs74.7 billion from VAT.

“The government’s VAT collection jumped this fiscal driven by higher imports,” MoF officials said, adding, “Almost 50 percent of VAT is collected from customs offices at border points.”

Another major contributor to the government’s revenue in the first nine months of the current fiscal year was income tax. The government raised Rs95.4 billion in income tax in the nine-month period, marking a year-on-year increment of 26 percent.

With this, contribution of income tax in the government’s total revenue stood at 22.8 percent.

The main reason for hike in income tax, according to officials, is growth in business activities since the normalisation of the supply situation.

Next in the league table of biggest contributors to state revenue was customs duty. Collection of customs duty surged 65.2 percent to Rs83.4 billion in the first nine months of the current fiscal year, largely because of jump in imports.

With this, customs duty’s contribution to total government revenue hovered around 20 percent.

Among others, collection of excise duty jumped 50.5 percent to Rs61.8 billion, non-tax revenue grew by 6.7 percent to Rs33.5 billion and vehicle tax collection soared by 24.9 percent to 7.1 billion, shows the NRB report.

9.12°C Kathmandu

9.12°C Kathmandu