Money

Nepse gains 46.09 points

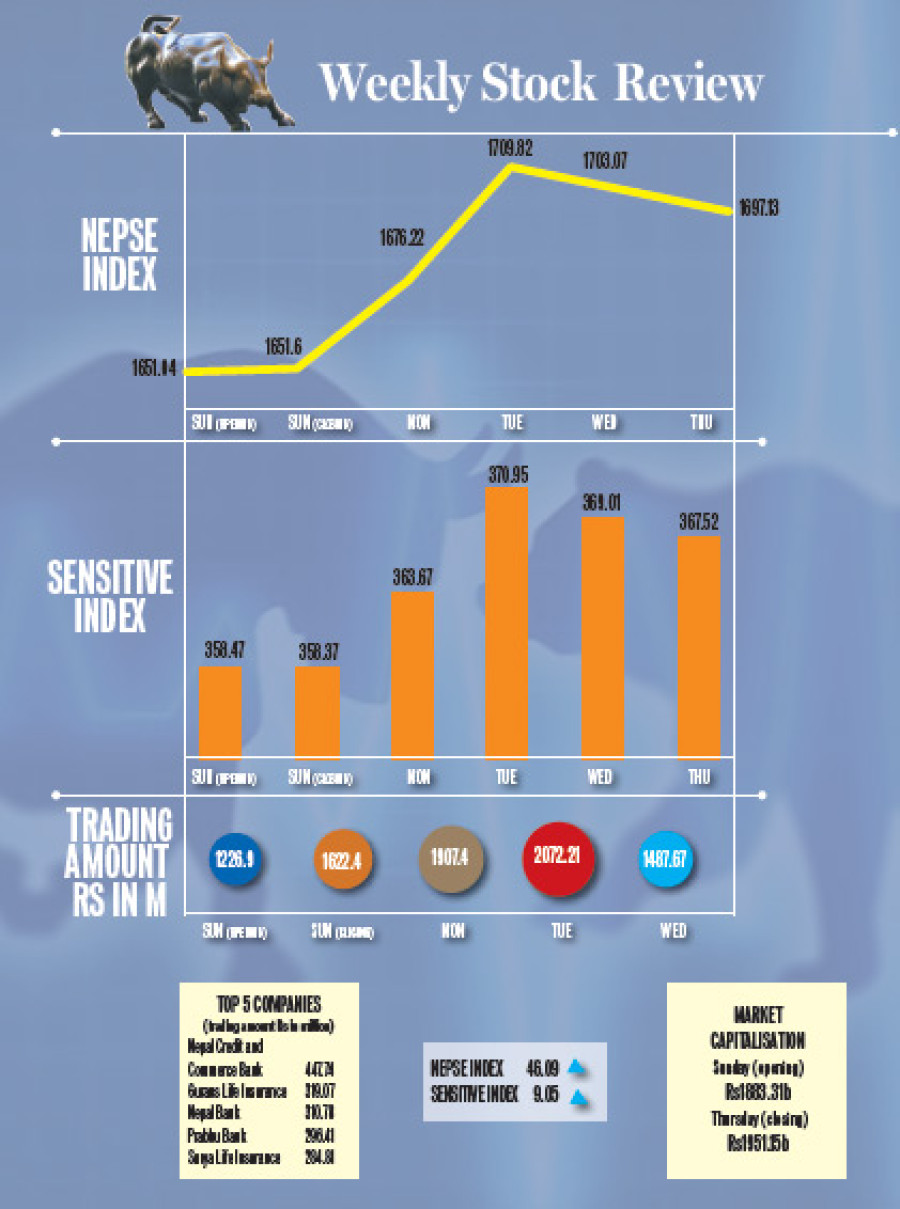

Nepal Stock Exchange (Nepse) gained 46.09 points to close at 1,697.13 points last week, with investors attracted to the possibilities of high returns from commercial banks that are due to reveal good financial health during their third quarter report.

Nepal Stock Exchange (Nepse) gained 46.09 points to close at 1,697.13 points last week, with investors attracted to the possibilities of high returns from commercial banks that are due to reveal good financial health during their third quarter report.

The secondary market opened at 1,651.04 points on Sunday and gained 0.56 points to close at 1,651.6 points. On Monday, the market surged by 24.62 points to close at 1,676.22 points. The market saw a similar surge on Tuesday, gaining 33.6 points to close at 1,709.82 points.

The market could not maintain the bullish momentum and dropped 6.75 points and 5.94 points on Wednesday and Thursday respectively. The capital market rose

2.79 percent in overall trading last week.

“The market has been affected by the investors attraction towards stocks of commercial banks as most of these financial institutions are likely to post a healthy profit in their third quarter report,” said Ram Chandra Bhattarai, managing director of Aryatara Investment and Securities. “Banks stepping up to improve liquidity in the market and the attraction for the insurance companies are also among the reasons for rebounding the market.”

With the rise in Nepse index, the average value of the shares listed in stock market also surged by Rs67.84 billion, with the market capitalisation soaring to Rs1,951.15 billion from Rs1,883.31 billion over the week.

Along with the Nepse index, the sensitive index that measures the performance of Group ‘A’ companies also gained 9.05 points to close at 367.52 points.

The insurance sub-index witnessed the largest gain of 189.84 points to close at 8,869 points. Stock prices of insurance companies have been on the rise for past few weeks after the regulator asked the insurance companies to increase their paid up capital.

Following in second place was the development bank sub-index, gaining 135.05 points to close at 1,966.63 points. The hotel sub-index gained 66.86 points to close at 2,206.2 points. Similarly, hydropower gained 38.13 points, commercial bank gained 33.97 points, finance companies gained 28.03 points while manufacturing and ‘others’ gained 8.11 and 5.21 points respectively.

The sub-index of trading was stable at 209.25 points throughout the week.

Last week, Nepal Credit and Commerce Bank led in terms of both transaction amount and number of traded shares. The bank observed a turnover amount of Rs447.74 million from the trading 993,000 shares.

According to Bhattarai, the bank’s announcement to provide 50 percent right shares to its shareholders had attracted the investors to purchase the bank shares.

Similarly, Gurans Life Insurance’s stocks worth Rs319.07 million were transacted. Nepal Bank, Prabhu Bank and Surya Life Insurance were also among the top five companies in terms of the largest turnover.

Last week, the shares of 157 listed companies were traded. Along with soaring market index, the transaction amount also increased by 27.06 percent to Rs8.31 billion. The traded number of shares also rose to 16,389,160 from 11,062,610 units.

9.6°C Kathmandu

9.6°C Kathmandu