Money

Profit of banks jumps 44pc in first quarter

The net profit of commercial banks surged by 44 percent in the first quarter of this fiscal year on the back of mergers and amid pressure to expand business in line with the expansion in capital base.

The net profit of commercial banks surged by 44 percent in the first quarter of this fiscal year on the back of mergers and amid pressure to expand business in line with the expansion in capital base.

A total of 28 commercial banks posted a net profit of Rs9.5 billion for the period between mid-July and mid-October, as against Rs6.6 billion recorded in the same period a year ago, show unaudited balance sheets of banks published till Monday.

“Banks were able to generate a high level of profit as many were able to expand their businesses in a pretty rapid manner,” said Sanima Bank CEO Bhuvan Kumar Dahal.

Lately, banks are under pressure to grow their businesses, as many have started replenishing their capital to meet the central bank’s new minimum paid-up capital requirement of Rs8 billion from the existing Rs2 billion within mid-July 2017.

In the first quarter, the total paid-up capital of 28 banks went up by 32 percent to Rs132.8 billion, compared to Rs101.9 billion in the same period last year. To ensure that the fresh capital injected into banks do not turn into liabilities, the institutions have also accelerated the pace of lending. Failure to expand credit portfolio may be counterproductive for banks that have raised their capital stock, as it would prevent them from increasing the profit level, which is essential to maintain the trend of dividend distribution of the past.

“Hike in capital has also provided banks access to non-interest bearing cash, contributing to raising the profit level,” said Dahal.

These are some of the key factors leading to the jump of banks’ net interest income by 38.6 percent to Rs17.7 billion in the first quarter of this fiscal year. A cursory glance at the net interest income portrays a picture of banks generating most of its income from core banking activities, but quite a number of institutions saw their profit level swell because of mergers, according to Dahal.

Banks like Sunrise, Bank of Kathmandu Lumbini, NMB, Siddhartha, Mega and Citizen completed the consolidation process at the end of the first quarter of last fiscal year, which automatically transferred assets of institutions with which they merged into their portfolio. “This is also one of the reasons that jacked up net profit of the banks,” said Dahal.

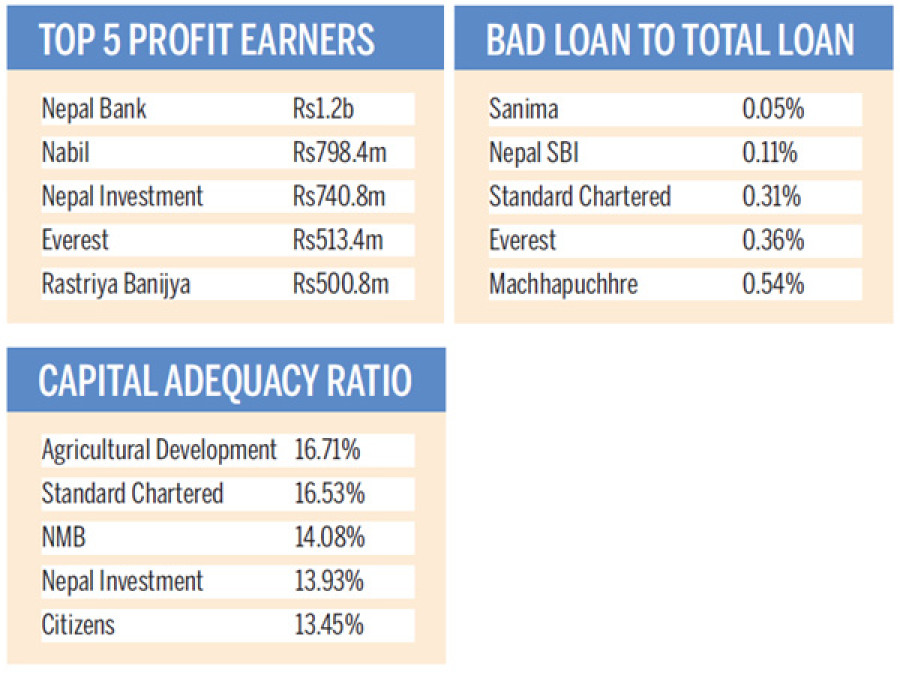

The unaudited balance sheets of banks show that the top earner in the first quarter was state-controlled Nepal Bank, which posted a profit of Rs1.2 billion. Second in the league table was Nabil Bank, which booked a profit of Rs798.4 million, followed by Nepal Investment Bank, which generated a profit of Rs740.8 million. Other top earners were Everest Bank, which booked a profit of Rs513.4 million, and state-owned Rastriya Banijya Bank, which earned a profit of Rs500.8 million.

8.12°C Kathmandu

8.12°C Kathmandu