Editorial

In the grey, again

Political party leaders are yet to internalise the importance of a clean and efficient fiscal sector.

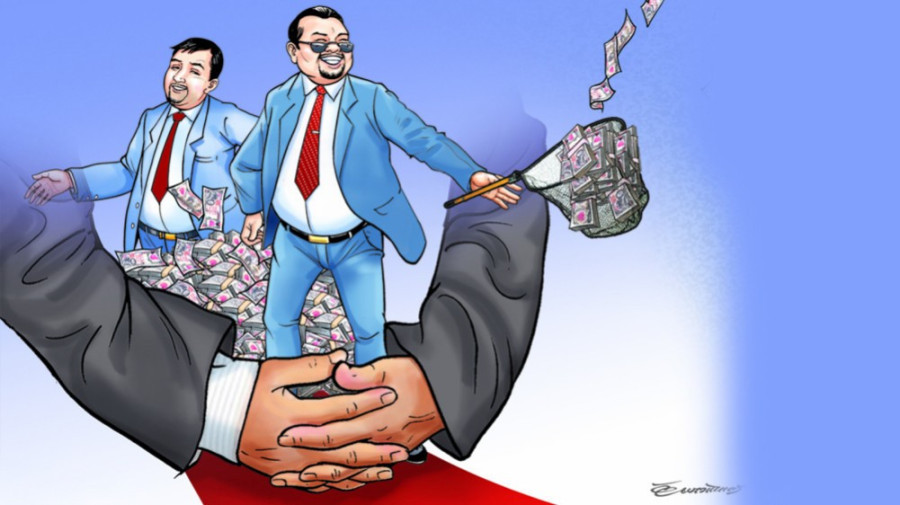

After multiple warnings, the Financial Action Task Force (FATF) has again put Nepal in its grey list, citing the country’s failure to tackle money laundering. (Previously, Nepal was in the infamous list between 2008 and 2014.) Its re-listing by FATF, an intergovernmental panel tasked with combating money laundering and terrorist financing, was no surprise though. With not a little help of the political leadership, the problems of fiscal mismanagement, corruption and money laundering have become entrenched. This wouldn’t be so if there was a clear political commitment to boost public spending, tackle corruption and control financial crimes. What we see instead is that top politicians themselves protect the corrupt and criminals. Whenever there is a big corruption scandal—of which there are plenty each year—lower level functionaries get arrested and prosecuted but most of the big fish are left untouched. It is the nexus of these political big fish and business mafia that leads to financial crimes of all kinds. This in turn puts into perspective some of the FATF’s recommendations for Nepal to exit from the grey list.

These include improving risk-based supervision of commercial banks, higher risk cooperatives, casinos, and real estate sector; demonstrating identification and sanctioning of materially significant illegal hundi providers; increasing capacity and coordination of competent authorities to conduct money laundering investigations; and demonstrating an increase in money laundering investigations and prosecutions. All these measures to ensure fiscal rectitude become hard to pull off when those who should ensure their implementation are themselves compromised. This is why the Nepali political leadership has not been able to implement the desired measures, despite repeated commitments to the FATF to do so. So how will Nepal suffer now that it is again a part of the grey list? Most damagingly, it could deter potential investors from Nepal as no country or institution wants to be seen as in any way abetting serious crimes like money laundering and terrorism financing. Nepalis are already the holders of one of the world’s weakest passports; the reputational damage done by the FATF grey listing could make it weaker still. All in all, Nepal’s image as a credible and responsible international actor will take a hit.

The impact of political meddling is open for all to see, whether in the Department of Anti-Money Laundering, the Commission for Investigation of Abuse of Authority, the Department of Revenue Investigation or the Nepal Police—all the agencies responsible for prosecuting fiscal crimes. In other words, these bodies have been badly politicised, their leaderships chopped and changed according to the whims of the political actors in power. The frequency of dubious transfers in these agencies suggests the authorities are more interested in protecting rather than punishing those involved in fiscal crimes. Finance Minister Bishnu Paudel has pledged immediate measures to ensure Nepal comes out of the list at the earliest. Rather than piecemeal action, it would help if the country’s political leadership internalised the importance of having a clean and efficient fiscal sector. This is vital not just for the country’s international image. It is even more important for Nepal’s sustainable growth and development.

22.85°C Kathmandu

22.85°C Kathmandu