Editorial

Probe FinCEN Files

Nepal must conduct independent investigations into the revelations and bring fraudsters, if any, to book.

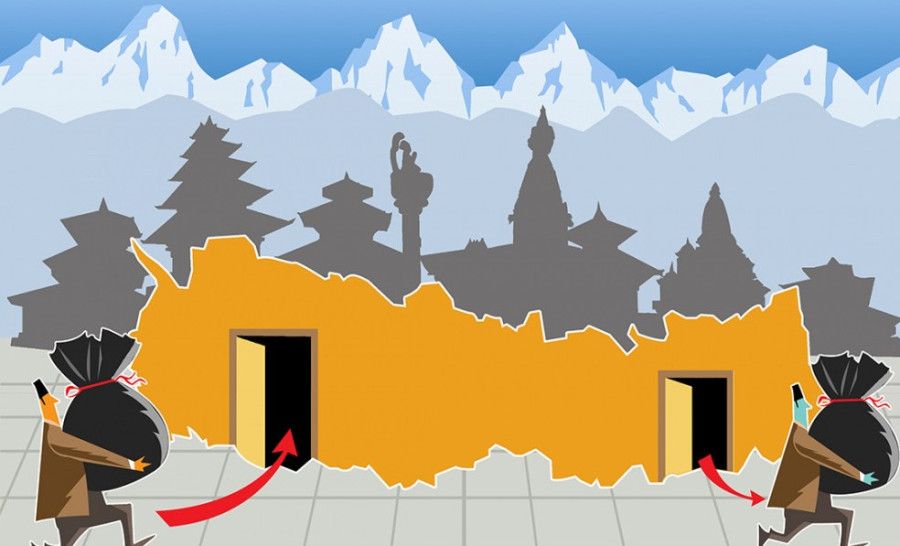

The FinCEN Files have revealed a litany of suspicious financial transactions worth Rs35 billion that 19 Nepali establishments were involved in for 11 years between 2006 and 2017. The FinCEN Files are the result of a huge collaborative work involving 400 journalists from 88 countries all over the world, investigating records of transactions from 1999 to 2017 during which period banks monitored suspicious financial activities of their customers and reported them to the Financial Crimes Enforcement Network (FinCEN), a government body that monitors financial transactions in the United States.

The year-long investigation has exposed how Nepal is also connected to the suspicious transactions through the use of gold, bitumen and archaeological materials. The Nepal nexus of the FinCEN Files exposes the suspicious transactions of nine banks and 10 companies directly involved in financial transactions as per the 24 reports on Nepal that the Centre for Investigative Journalism (CIJ)-Nepal studied in collaboration with the International Consortium of Investigative Journalists (ICIJ) and BuzzFeed.

The CIJ-Nepal has, after examining the files, made three major revelations. They include $103 million making an exit and $74.6 million entering Nepal, showing a total of $177.6 million worth of suspicious transactions; a lump sum amount of $48.2 million traded or transferred illegally in various countries, including Nepal; and the names of the banks, companies and individuals who had traded suspicious money abroad using Nepali names, surnames and addresses. The third of the revelations does not show the involvement of financial institutions, banks or companies based in Nepal but the transfer of $66.8 million done by individuals of Nepali origin living abroad.

The suspicious transactions hint at a vacuum in financial administration in Nepal. An earlier investigation by CIJ-Nepal, named Nepal Leaks 2019, exposed how 55 Nepalis invested in several foreign countries despite restrictions placed by Nepali laws. It also exposed how almost a dozen business groups channelled illegal wealth abroad and brought it back into the country as foreign direct investment. Very little has been done about those revelations in terms of bringing the guilty parties to book.

Called Suspicious Activity Reports or SARs, the FinCEN Files, whose existence the banks do not even acknowledge, are not exact proof of illegality. But they reveal the red flags raised by watchdogs within banks on the basis of past reports of transactions that involved or hinted at financial crimes or involved clients with high-risk profiles. In effect, the huge cache of secret documents opens a Pandora's box of possible cases of money laundering, terrorism, drug dealing or financial fraud globally.

The global investigating journalists have done their job, looking into the details of usually inaccessible papers, classifying the kinds of possible frauds, and bringing them into the public. It is now the job of Nepal's financial regulators, including Nepal Rastra Bank, to conduct independent investigations into the revelations to identify the exact nature of the fraud, if any, and bring the guilty party under the purview of the laws and regulations of the country.

9.89°C Kathmandu

9.89°C Kathmandu