Columns

Stability or stagnation?

To actively pursue development, Governor Poudel must articulate a vision beyond risk management.

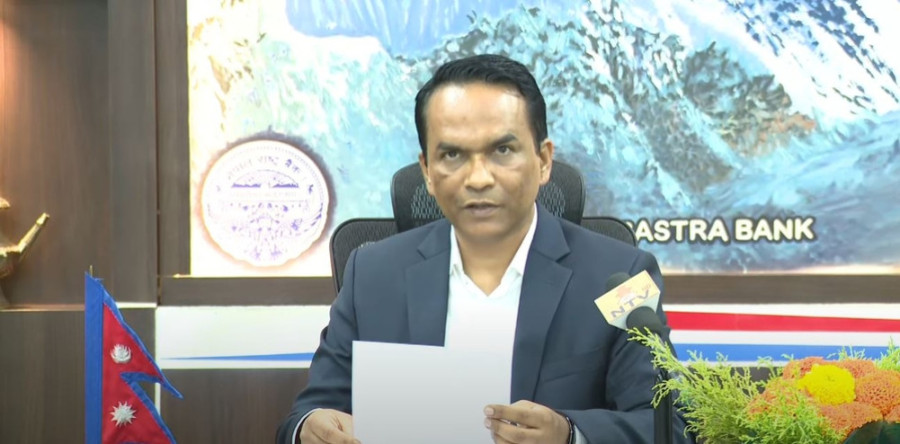

Bhojraj Poudel

Nepal Rasta Bank (NRB) Governor Biswo Nath Poudel unveiled the Monetary Policy 2025-26 last week. The policy arrives at a time when Nepal is facing prolonged stagnation, shrinking investment and declining aggregate demand, coupled with a volatile global financial landscape. The central bank’s policy, which is shaped by Poudel’s vision, carries significant weight. Yet, it also raises critical questions about whether the necessary decisiveness and boldness will accompany its implementation.

The economic malaise Nepal faces is not simply a cyclical downturn but one riddled with deeper structural issues. The country’s limited industrial diversification, infrastructure gaps and political instability have long constrained growth. Investment has contracted, and aggregate demand has weakened. The fiscal policy for 2025-26 is considerably less ambitious, lacking a clear vision to energise the economy. Following this cautious fiscal stance, the monetary policy emphasises stability and prudence. While caution is understandable given the global and domestic uncertainties, it risks perpetuating a cycle of underperformance. So, a question arises: Is this policy a roadmap for recovery or a reflection of resigned conservatism?

A notable concern is the policy’s suggestion to encourage investment in the real estate sector. While real estate can provide short-term economic stimulus, it is not a sustainable solution for economic development. Overreliance on real estate risks inflating asset bubbles without generating the broad-based growth that comes from productive investment in industry, technology and innovation. Nepal’s economy needs investments that create jobs, enhance productivity and foster diversification.

Moreover, a critical bottleneck remains in financing innovative ideas. Despite abundant entrepreneurial energy and creative concepts, these ideas often fail to secure funding through project financing, a prerequisite for innovative economic development. Nepal’s potential for dynamic growth remains constrained without mechanisms to finance projects that translate ideas into scalable businesses. The monetary policy could have done more to address this gap by promoting financial instruments and institutions that support project-based lending and innovation financing.

The broader issues of development finance and the persistent financing gap further compound the challenge. As Nepal prepares to graduate from the Least Developed Country (LDC) category in 2026, the stakes are even higher. LDC graduation will bring new opportunities as well as challenges, as Nepal will lose access to certain international concessional financing and preferential trade arrangements. To sustain its development trajectory and meet the Sustainable Development Goals (SDGs), Nepal must mobilise significant additional financial resources.

Monetary policy’s magic

Poudel’s involvement lends the policy a sense of earnest concern and rigour. His vision acknowledges the need for strengthening regulatory frameworks to bolster financial institutions’ resilience. These are essential steps, especially as the global economy faces multiple threats—from ongoing conflicts like the war in Gaza to escalating tariff wars that unsettle trade relations worldwide. For a small and open economy like Nepal, these external shocks translate into volatile FDI inflow, fluctuating remittances and uncertain export markets.

Yet, vision alone is not enough. Nepal’s history is replete with well-crafted policies that faltered in implementation due to political inertia or competing interests. The real test of Poudel’s monetary policy lies in his willingness to act decisively, to be ruthless, if necessary, in enforcing reforms that may be politically uncomfortable but economically vital.

One key feature of this monetary policy is its focus on liquidity management and interest rates. The NRB continues to use traditional instruments such as the repo rate and statutory liquidity requirements to influence money supply and credit availability. This approach aims to ensure that banks have sufficient funds to support productive lending while keeping inflation in check. At the same time, the policy promotes digital finance and payment systems, recognising the potential of technology to enhance financial inclusion and efficiency.

Similarly, strengthening the banking sector’s resilience is another priority. The policy enforces capital adequacy norms aligned with international Basel standards, ensuring banks maintain sufficient capital buffers against risks. It also emphasises risk management, particularly in monitoring and reducing non-performing loans (NPLs), which have long plagued Nepal’s financial institutions. Supporting microfinance institutions and cooperatives is part of this broader strategy, acknowledging their critical role in extending credit to underserved sectors and promoting inclusive growth.

Likewise, the policy’s encouragement of digital innovation is noteworthy. Expanding mobile banking, digital payments and regulatory sandboxes for fintech innovation can increase access to financial services, especially in rural areas where traditional banking infrastructure is limited. This digital push could stimulate economic activity and help reduce poverty, aligning with Nepal’s broader development goals.

Despite these positive elements, the policy’s cautious tone and alignment with a less ambitious fiscal policy raise concerns about its transformative potential. Economic growth requires not only sound monetary management but also bold structural reforms, investment in key infrastructures and innovative ideas. To break this cycle, Nepal needs clear goals for growth, employment and inflation control. Poudel must articulate a vision beyond managing risks to actively pursuing development. This requires a will to implement reforms decisively, even when they challenge entrenched interests or require difficult trade-offs.

Lessons from global leadership

Following the 2008 global financial crisis, US Federal Reserve Chair Ben S Bernanke and his team worked tirelessly, deploying every tool to stabilise the financial system. They faced immense political pressure—from a fractious Congress and a public outraged by Wall Street’s excesses—but their creativity and decisiveness prevented an economic collapse of unimaginable scale. Their unorthodox programmes stabilised the US economy and became models for other countries navigating the crisis. What stands out in Bernanke’s story is not just his technical expertise but his courage to act decisively in the face of uncertainty and opposition. For Poudel, Bernanke’s example could be a lesson on the importance of courage and decisiveness.

Nepal’s challenges may differ in scale and nature, but the need for bold leadership is no less urgent. Implementing the monetary policy effectively requires sound technical design and the political will to enforce reforms, confront vested interests and push through difficult decisions. The Monetary Policy 2025-26 is a step in the right direction, but it is only the beginning. The real challenge lies in driving Nepal towards lasting prosperity, especially as the country stands on the threshold of LDC graduation.

14.12°C Kathmandu

14.12°C Kathmandu