Columns

How the Euro divided Europe

Twenty years after its creation, the euro remains a fair-weather construction.

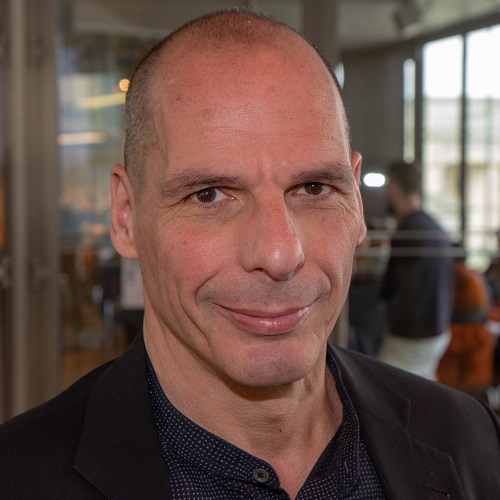

Yanis Varoufakis

Twenty years ago this month, Europe’s common currency became a tangible reality with the introduction of euro banknotes and coins. To mark the occasion, eurozone finance ministers issued a joint statement that called the currency “one of the most tangible achievements of European integration.” In fact, the euro did nothing to promote European integration. Quite the contrary.

The euro’s primary purpose was to facilitate integration by eliminating the cost of currency conversions and, more importantly, the risk of destabilising devaluations. Europeans were promised that it would encourage cross-border trade. Living standards would converge. The business cycle would be dampened. It would bring greater price stability. And intra-eurozone investment would yield faster productivity growth overall and convergent growth between member countries. In short, the euro would underpin the benign Germanisation of Europe.

Twenty years later, none of these promises has been fulfilled. Since the eurozone’s formation, intra-eurozone trade grew by 10 percent, substantially lower than the 30 percent increase in global trade and, more significantly, the 63 percent increase in trade between Germany and a trio of European Union countries that did not adopt the euro: Poland, Hungary, and the Czech Republic.

It’s the same story with productive investments. A huge wave of loans from Germany and France washed over eurozone countries like Greece, Ireland, Portugal, and Spain, resulting in the sequential bankruptcies that lay at the heart of the euro crisis a decade ago. But most foreign direct investment went from countries like Germany to the part of the EU that chose not to adopt the euro. Thus, while investment and productivity were diverging within the eurozone, convergence was being achieved with the countries that remained outside.

As for incomes, back in 1995, for every €100 ($114) earned by the average German, the average Czech earned €17, the average Greek €42, and the average Portuguese €37. Of the three, only the Czech could not withdraw euros from a domestic ATM after 2001. And yet, her income in 2020 converged toward the average German’s €100 income by a whopping €24, compared to just €3 and €9 for her Greek and Portuguese counterparts, respectively.

The key question is not why the euro failed to bring about convergence, but rather why anyone thought it would. A look at three pairs of well-integrated economies offers useful insights: Sweden and Norway, Australia and New Zealand, and the United States and Canada. Close integration of these countries grew—and was never jeopardised—because they avoided monetary union.

To see the role of monetary independence in keeping their economies closely aligned, consider their inflation rates. Since 1979, the rate of inflation has been broadly similar in Sweden and Norway, in Australia and New Zealand, and in the US and Canada. And yet, during the same period, their currencies’ bilateral exchange rates fluctuated wildly, acting as shock absorbers during asymmetrical recessions and banking crises and helping to keep their integrated economies in alignment.

Something similar happened in the EU between Germany, the leading eurozone economy, and euro-less Poland: When the euro was created, the Polish złoty depreciated by 27 percent. Then, after 2004, it appreciated by 50 percent, before falling again, by 30 percent, during the financial crisis of 2008. As a result, Poland avoided both the foreign-debt-fueled growth that characterised eurozone members like Greece, Spain, Ireland, and Cyprus, and the massive recession once the euro crisis was in full swing. Is it any wonder that no EU economy has converged more impressively with Germany’s than Poland’s?

In retrospect, it was as if the architecture of the euro was designed to cause maximum divergence. In effect, Europeans created a common central bank that lacked a common state to have its back, while simultaneously allowing our states to carry on without a central bank to have their backs in times of financial crisis, when states must bail out the banks operating in their territory.

During the good times, cross-border loans created unsustainable debts. And then, at the first sign of financial distress (either a public or a private debt crisis), the writing was on the wall: a eurozone-wide spasm whose inevitable outcome was sharp divergence and enormous new imbalances.

In layperson’s terms, Europeans resembled a hapless car owner who, in an effort to eliminate body roll around corners, removed the shock absorbers and drove straight into a deep pothole. The reason countries like Poland, New Zealand, and Canada weathered global crises without falling behind (or, worse, surrendering sovereignty to) Germany, Australia, and the US is precisely that they resisted a monetary union with them. Had they succumbed to the lure of a common currency, the crises of 1991, 2001, 2008, or 2020 would have rendered them debt colonies.

Some argue that Europe has now learned its lesson. After all, in response to the euro crisis and the pandemic, the eurozone has been reinforced with new institutions such as the European Stability Mechanism (a common bailout fund), a common supervisory system for European banks, and the Next Generation EU recovery fund.

These are undoubtedly large changes. But they constitute the minimum that was needed to keep the euro afloat without changing its character. By implementing them, the EU confirmed its readiness to change everything in order to keep everything the same—or, more precisely, to avoid the one change that matters: the creation of a proper fiscal and political union, which is the prerequisite for managing macroeconomic shocks and eliminating regional imbalances.

Twenty years after its creation, the euro remains a fair-weather construction, fueling divergence rather than driving convergence. Until recently, this outcome inspired heated debates—and thus hope that Europe was aware of the centrifugal forces threatening its foundations.

This is no longer so. When the eurozone finance ministers issued their joint paean to the single currency, something remarkable happened: Nothing. No one joined in the celebrations. No one cared enough to dissent. Such apathy does not bode well for a union that is being torn apart by widening inequality and xenophobic populism.

—Project Syndicate

10.12°C Kathmandu

10.12°C Kathmandu